Homeownership Program Qualifications

HABITAT HOMEOWNERSHIP PROGRAM PARICIPANTS ARE SELECTED BASED ON THREE PRINCIPLES:

- Need for Decent Housing in Berkeley County

In order to be eligible for the Habitat Homeownership Program, there must be a definitive housing need. Examples include, but are not limited to:

- Living in overcrowded housing.

- Living in substandard housing conditions (i.e. disrepair, unsanitary, unsafe).

- Cost burdened - paying more than 30% of gross income on rent.

- Homeless

| Please

note: All homeownership program participants must either live or

work

in the Habitat for Humanity of Berkeley County service area for the past 12 consecutive months

. |

2. Ability to Pay:

There must be sufficient consistent, verifiable household income to afford the Habitat monthly mortgage payment, utility bills such as water and electricity, and other debts (credit cards, car payments, etc.), with sufficient funds remaining to cover family necessities, such as food and clothing. We accept all stable sources of verifiable income (including SSI, SSA, etc.). For those who are employed, 'gross monthly income' from your employer is the income that you receive before tax, benefits and/or other payroll deductions.

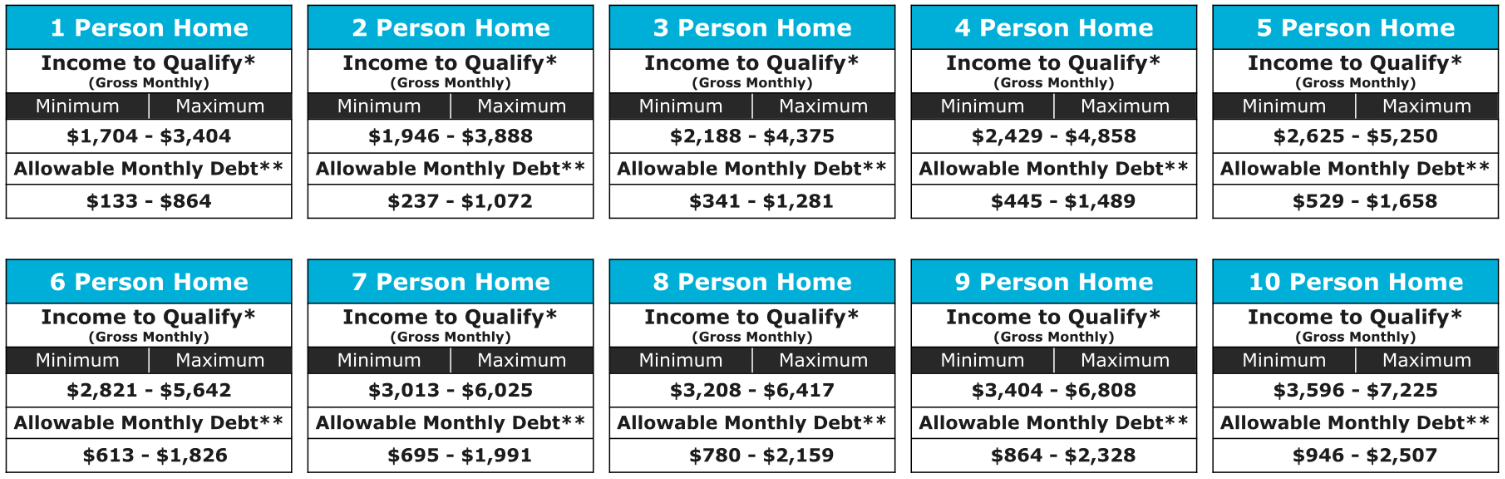

Total 'gross monthly' household income must be between the minimum and maximum HUD area median income limits per the number of people in the household - see chart below for reference. For example, currently, a household of 4 must have a gross monthly household income between $2,429 and $4,858. Household income is defined as any/all steady sources of income from all adults in a household.

Income and debt must fall between the minimum and maximum range per size of household (see chart below).

- Included in Debt Calculation: Credit card payments, car loan payments, student loan payments, child support payments, alimony payments, etc.

- Excluded in Debt Calculation: Monthly utility payments (i.e. electric, gas, water/sewer, etc.).

*Income at 30%-60% - 2023 HUD Area Median Income Limits (Note: gross monthly income = income before taxes/deductions).

**Allowable Monthly Debt includes projected Habitat monthly housing cost payment.

3. Willingness to Partner

Habitat homeownership program participants must be willing to complete a minimum of 250 hours (per adult) of sweat equity, including construction of their home and other Habitat homes. In addition, they will be required to attend homeownership education classes and community events.

Willingness to partner actually begins the homeownership program selection process starts. We expect prospective homebuyers to:

- Meet all deadlines

- Attend required meetings, classes, and events (arriving on-time)

- Be communicative and honest

- Complete all sweat equity hours and closing costs before moving into their home